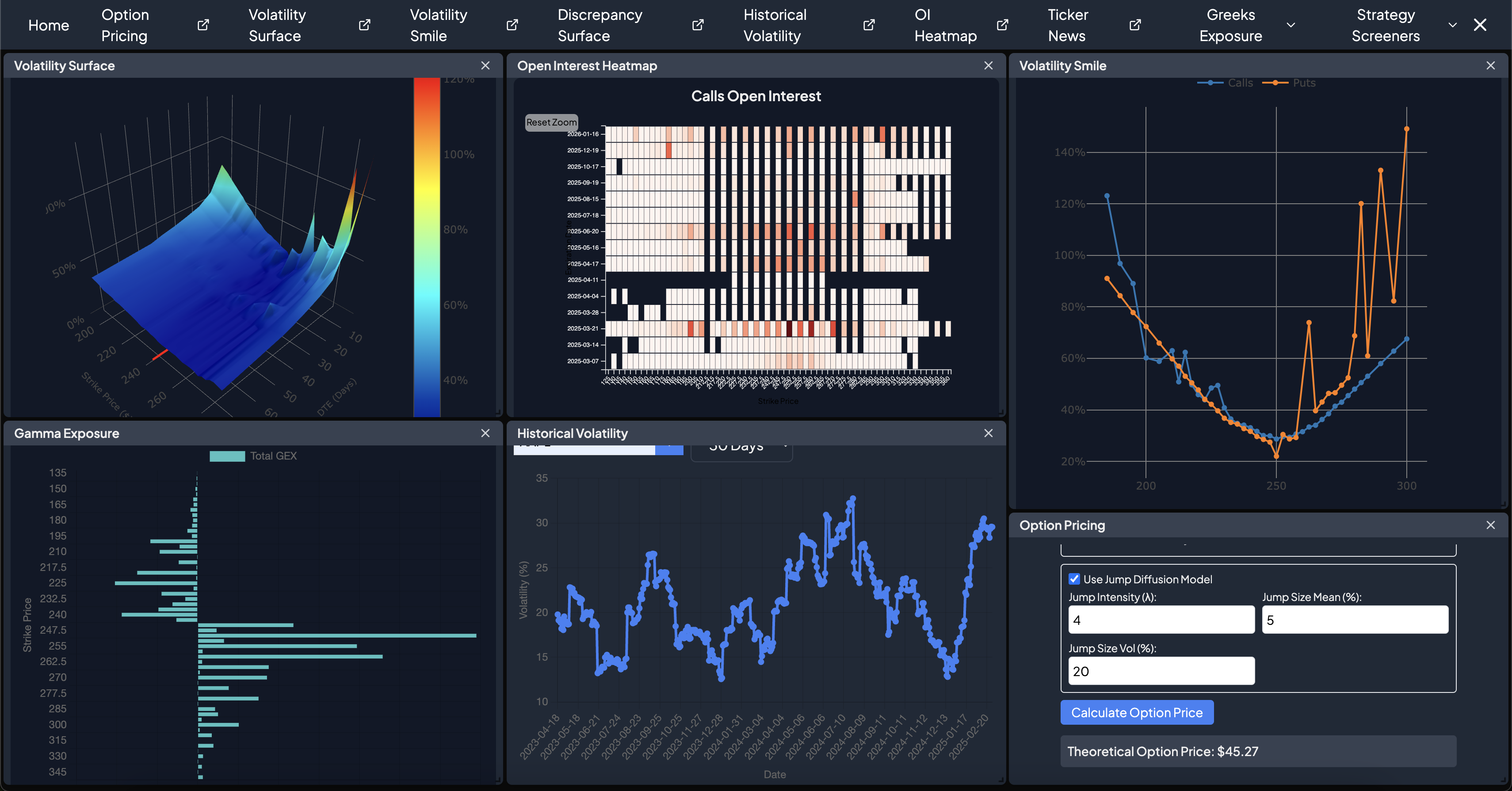

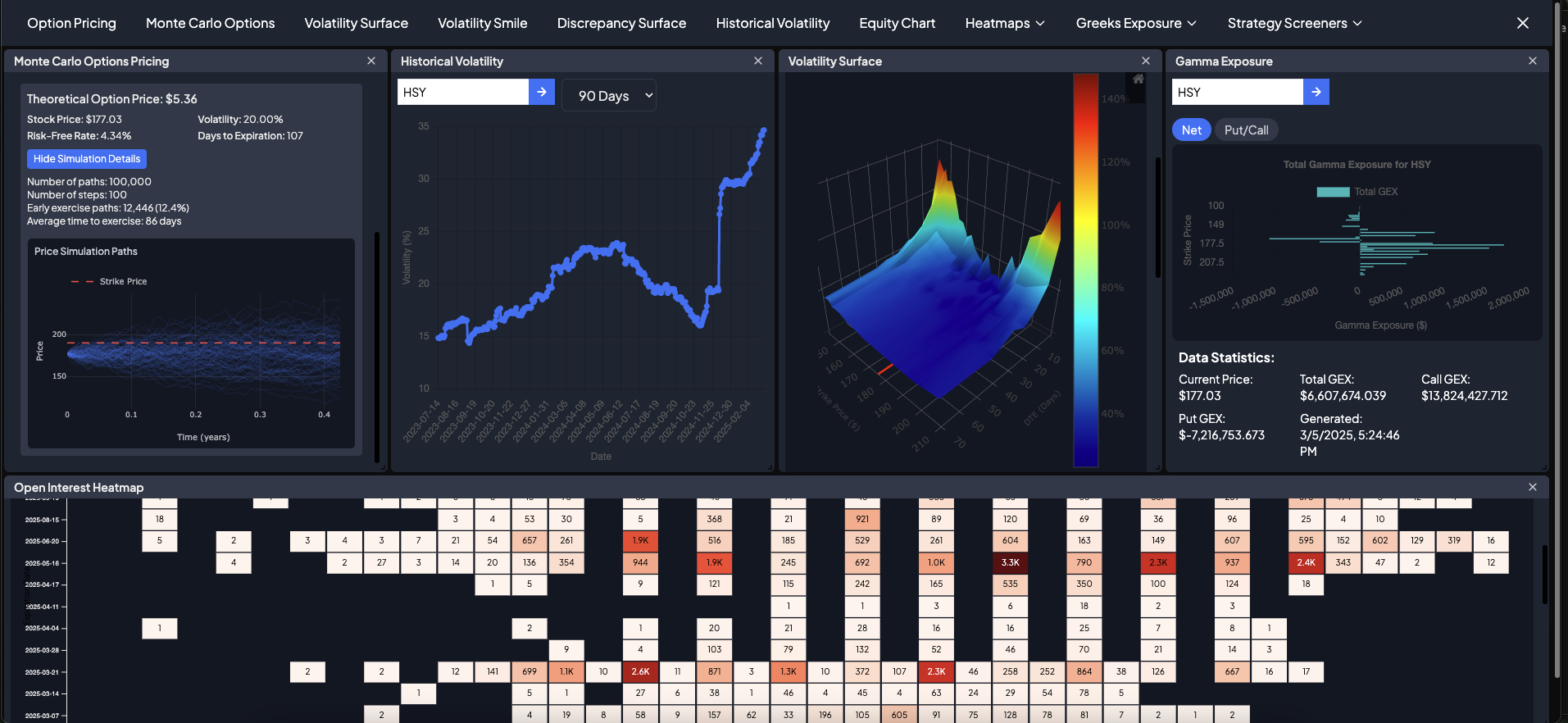

Custom Trading Terminal

About the Project

This is a custom-built trading terminal that I developed as a Next.js web application. The terminal runs locally on my machine and provides real-time market data, analysis and visualizations. I chose to build this using this framework for the user interface because it was easier to impliment than a custom interface and it can be easily shipped as a live webapp. I use this app regularly as part of my analysis for my real world trading.

Features

- Dynamic masonry style interface that allows the user to customize the size and placement of components on the dashboard

- Option pricing

- Standard(BSM variant)

- Standard with jump idffusion parameters

- Monte carlo simulation

- Volatility surface

- Volatility smile(skew)

- Historical volatility graph of a given US equity

- Historical US equity price and volume chart

- Heatmaps

- Open interest

- Volume

- VWAP

- Greeks

- Greeks exposure graphs

- Gamma

- Delta

- Vanna

- Charm

- Strategy screeners

- Long call/put

- Covered call

- Cash secured put